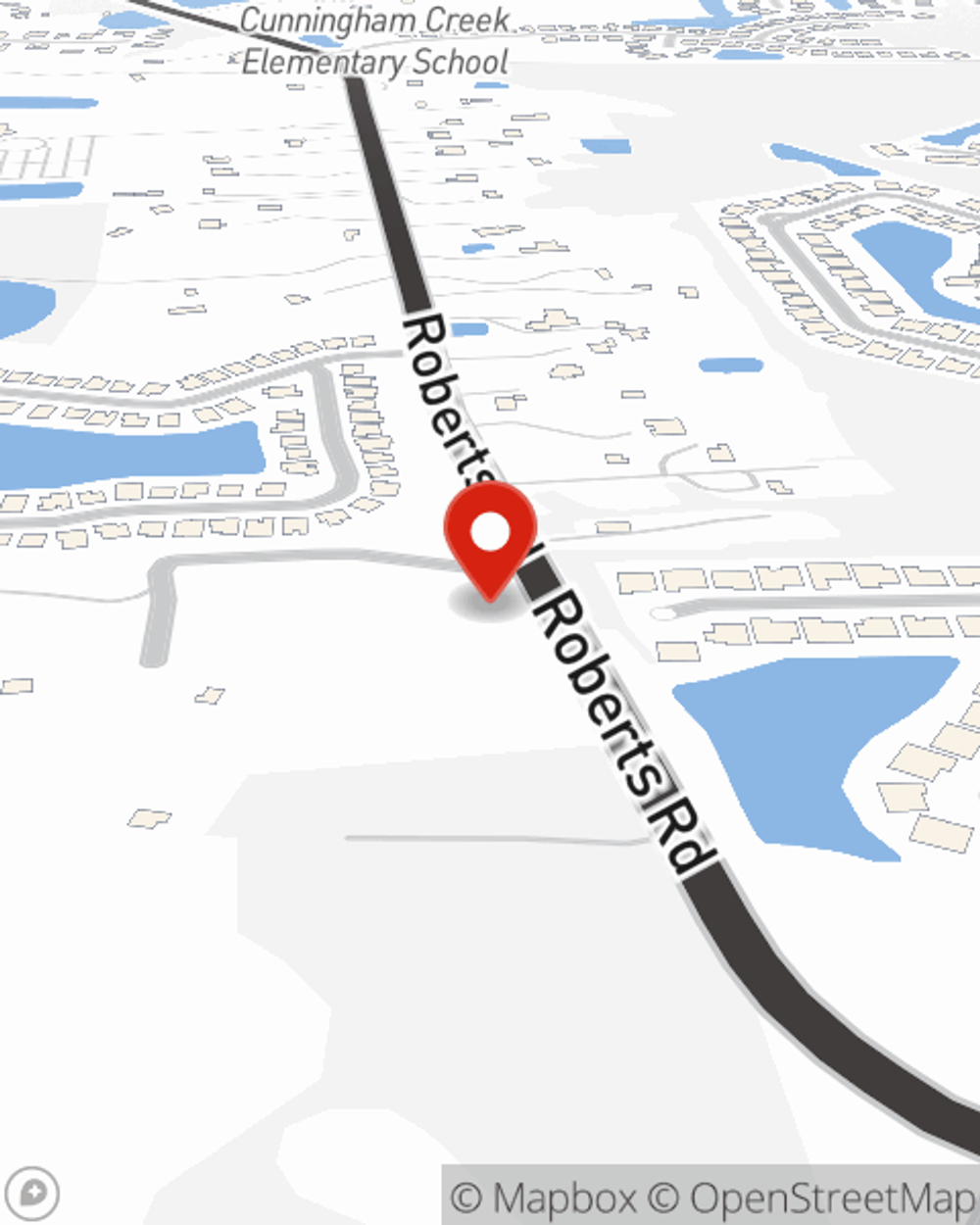

Business Insurance in and around Saint Johns

One of the top small business insurance companies in Saint Johns, and beyond.

Cover all the bases for your small business

- Saint Johns

- Jacksonville

- Duval County

- Saint Augustine

- Clay County

- Orange Park

- Middleburg

- Mandarin

This Coverage Is Worth It.

You've put a lot of elbow grease into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a pet groomer, a hair salon, an art gallery, or other.

One of the top small business insurance companies in Saint Johns, and beyond.

Cover all the bases for your small business

Protect Your Business With State Farm

You are dedicated to your small business like State Farm is dedicated to reliable insurance. That's why it only makes sense to check out their coverage offerings for business owners policies, commercial auto or artisan and service contractors.

As a small business owner as well, agent Brandi Mark understands that there is a lot on your plate. Reach out to Brandi Mark today to discuss your options.

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Brandi Mark

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.